2020: Quarter 1 Newsletter

Have you completed your “Lookback” test?

If your 403(b) Plan excludes all employees who work an average of 20 hours or less per week—or 1,000 hours or less per year—you must complete two tests to ensure no one is excluded in error.

The first test is completed on the employee's date of hire, and the second test is a "lookback" test completed each 12-month period, or every plan year.

Improper exclusion of employees who otherwise are eligible to participate can put your plan at risk of non-compliance. If you have questions or concerns, please contact us.

Did You Know?

When it comes to processing 403(b) and 457(b) contributions, time is of the essence. The Department of Labor requires that Plan Sponsors remit deferrals to their approved provider as soon as administratively feasible and no later than the 15th day of the month following the date of deduction.

At AFPlanServ, we recommend remitting contributions with every payroll because combining them into a single deposit may increase the risk of violating this rule.

AFPlanServ's remittance program may help you ensure timely submission, and our electronic services are offered to our clients at no additional expense.

Plan Document Restatement

All organizations sponsoring a 403(b) Plan must "restate" their Plan documents into an Internal Revenue Service (IRS) approved plan by March 31, 2020, in order to take advantage of the "free pass" on document errors. Restatement to an IRS pre-approved plan gives you—the Plan Sponsor—reliance that the provisions in the pre-approved plan are compliant with current IRS rules and regulations.

As of September 1, 2017, all 403(b) Plans under AFPlanServ administrative services were amended and restated to operate under a pre-approved plan. A copy of the Volume-Submitter pre-approved Plan Document was provided to all groups in mid-2017, along with an amended Plan Adoption Agreement.

If you need a copy of your amended document or any other plan documents, please contact us at 866-560-6415.

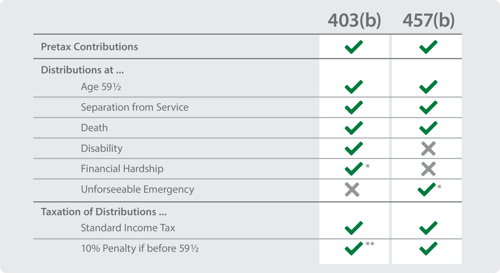

403(b) and 457(b): What's the difference?

*If allowed in employer’s plan. Unless an IRC exception applies.

**Unless retired at 55 or older.

Help Us Help You!

As your third-party administrator, transaction processing is the majority of what we do. This involves the approval of distributions, exchanges, loans, hardships, transfers, and Salary Reduction Agreements. We provide this service to relieve the burden from you and help ensure your plan stays in compliance with IRS guidelines. Additionally, this service enables us to maintain a single record of transaction approvals for your plan in the event of an IRS audit.

We want to emphasize that requests for transaction approvals must not be signed by the school district, as this is part of the services AFPlanServ provides for you. This includes requests from retired or terminated employees.

Instead, all transaction requests must be forwarded to AFPlanServ for approval. If AFPlanServ does not perform all transaction approvals, your plan may be more likely to engage in an operational error that will require correction and possible penalties.

Frequently Asked Questions

Q: May Plan contributions be deducted and remitted to providers that are not approved under the Plan?

A: No. Plan contributions may only be processed for contributions that are remitted to an approved provider.

Q: Who are the Approved Providers in my Plan?

A: A listing of providers may be obtained by contacting us at 866-560-6415.

Plan Reminders

Each year, AFPlanServ provides a Sample Plan Eligibility Notice to help satisfy the Universal Availability requirements.

You may use this as a template for your own customized notification or distribute the sample in its entirety.

Please check the Operational Guidelines to ensure that you are adhering to the items listed. If you have any questions, please contact us.

If you need more information about your role as the Plan Sponsor, we're happy to help!